Your guide to buying an investment property

Investing in real estate is more than just buying property; it’s about strategic planning and smart decisions that pave the way for financial growth and stability. With the right approach, the potential for asset appreciation, tax benefits, and steady rental income can transform your investment into a powerful income stream.

But success in the property market doesn’t come from chance – it comes from understanding the nuances and executing with precision. When it comes to buying an investment property, we’ve got your back.

Investment property 101

Investment properties aren’t just pieces of real estate. They’re strategic acquisitions aimed at generating financial returns, either through future resale of the property, rental income, or both.

Different types include:

- Residential properties: These can include single-family homes, duplexes, multi-unit apartments, and everything else in between. Residential investments are familiar and typically easier to manage, making them ideal if you’re a first-time investor.

- Commercial properties: This includes office spaces, retail locations, and any other service-oriented building. These properties usually offer longer lease terms, which can provide a more stable income stream.

- Industrial properties: Factories, warehouses, and manufacturing buildings fall into this group. These properties often feature higher rental yields and longer leases due to their specialised use and limited competition.

The benefits of property investment

Passive income

The most obvious one is the passive income you receive from rental payments. This consistent cash flow can help cover all of the costs that come with the mortgage, taxes, and maintenance of the property, potentially allowing you to profit every month. Rental income is, for the most part, predictable, especially with long-term leases in place, giving you some financial stability month-to-month.

Capital growth

The beauty of property investment is that property typically increases in value over time due to things like market demand and improvements made to the property. This appreciation builds equity and can often result in a substantial profit when the property is sold. For many investors, capital appreciation is the long-term reward of real estate investment.

Tax advantages,

As a property investor, you’ll generally have access to a number of tax deductions, including property management fees, repair and maintenance costs, interest on loans used to purchase the property, and property depreciation. Plus, negative gearing allows you to deduct any net loss made on the property from your other taxable income, potentially reducing your overall tax liability.

Read more about what you can claim on an investment property.

Leverage

Real estate is one of the few investment opportunities that can be leveraged, meaning you can use borrowed capital to increase the potential return of an investment. For example, by paying a percentage of a property’s price upfront and borrowing the rest, you can purchase a more valuable asset than you could afford outright.

Portfolio diversification

Adding real estate to an investment portfolio can reduce risk through diversification. Property has a low – and in some cases negative – correlation with other major asset classes. This means it can reduce volatility and provide a higher return per unit of risk.

Control over investment

Real estate gives you a high degree of control as an investor. You can directly influence the performance and value of your investment through improvements, choice of tenants, and management strategies.

Community development

By investing in a property, you can contribute to the development and improvement of communities. This is particularly rewarding if you’re also involved in projects that rejuvenate neighbourhoods or provide needed housing.

Preparing to buy

Don’t underestimate the importance of thorough preparation! Here’s how to set the stage.

Financial preparation

Start with a clear understanding of your current financial situation. This means reviewing your assets, liabilities, and cash flow. Budgeting is crucial; you’ll need to account not just for the purchase price, but also for ongoing expenses like property management, maintenance, taxes, and insurance.

Securing finance is the next step. Compare different mortgage options to find the best rates and terms. Consider chatting with a financial advisor or mortgage broker who can provide tailored advice based on your financial status and investment goals.

Do you research

Knowing the market is key to a profitable investment.

Research different areas to understand where the best growth potential lies. Look at factors like population growth, employment rates, and future infrastructure developments – any indicators that a suburb is up-and-coming.

Make sure to also look at average rent, property values, and occupancy rates to gauge the market’s stability and potential yield. Tools like websites from Perth real estate agencies, market analysis reports, and consultations with local agents can provide some valuable insight if you’re unsure.

Goal setting

What do you want to achieve with your investment? Are you looking for quick, short-term gains through a flip? Or are you more interested in long-term wealth accumulation through rental income and property appreciation? Your strategy will influence the type of property you buy, the location, and how much you’re willing to spend.

For instance, short-term investors might look at properties under market value that can be quickly renovated and sold for a profit. Long-term investors will likely prioritise location and the potential for steady rental demand.

Finding the right property

Now that you’ve done all the research prepping, let the property hunt begin! Depending on your goals, you’ll need to consider a few different things to make sure it meets your long-term goals. Here’s how to identify the properties that offer the best potential returns.

Selection criteria

This is not always a one-size-fits-all, but keep an eye out for some of these criteria:

- Location: Look for areas with high demand for rentals, good schools, plenty of employment opportunities, and amenities like parks, shops, and public transport. A good location means sustained tenant interest and property value appreciation.

- Price: The property should fit within your budget but also promise a good return on investment. Assess the price in relation to the current market to avoid overpaying.

- Condition: The state of the property affects both your initial investment and ongoing maintenance costs. A fixer-upper might offer a lower purchase price and the potential for significant value increase through renovations, while a turnkey property, though more expensive, can be rented out immediately.

- Growth potential: Properties in areas poised for growth due to future developments or infrastructure projects can be lucrative options.

Evaluating potential

How do you know if a property has investment potential? Look at some of these things:

- Rental yield: Calculate the potential rental yield (annual rental income divided by the property price) to gauge if the returns meet your expectations.

- Appreciation trends: Have a look at historical price data in the area to predict future property value increases.

- Cost analysis: Consider all costs, including purchase, potential renovations, ongoing maintenance, and property management to make sure the investment still remains profitable.

- Market demand: Take a look at vacancy rates and tenant demand in the area. High demand and low vacancy rates usually signal a robust rental market.

Read more about what makes a good investment property.

Tools and resources

There are a bunch of tools and resources available to help you assess and make your decision. Look at:

- Real estate websites: There are so many great sources of information out there that provide comprehensive listings and market trends that can help you identify potential investments.

- Real estate agents: A knowledgeable local agent (like our experienced agents!) can offer valuable insights into the area and potentially access to off-market deals.

- Property investment groups: Joining these can connect you with fellow investors and industry experts who share opportunities and advice.

- Investment seminars and webinars: Have a look at what’s available online. They can provide education on market analysis, property selection, and investment strategies.

The buying process

Navigating the buying process calls for a coordinated effort with trusted professionals and a thorough understanding of the legal and financial implications.

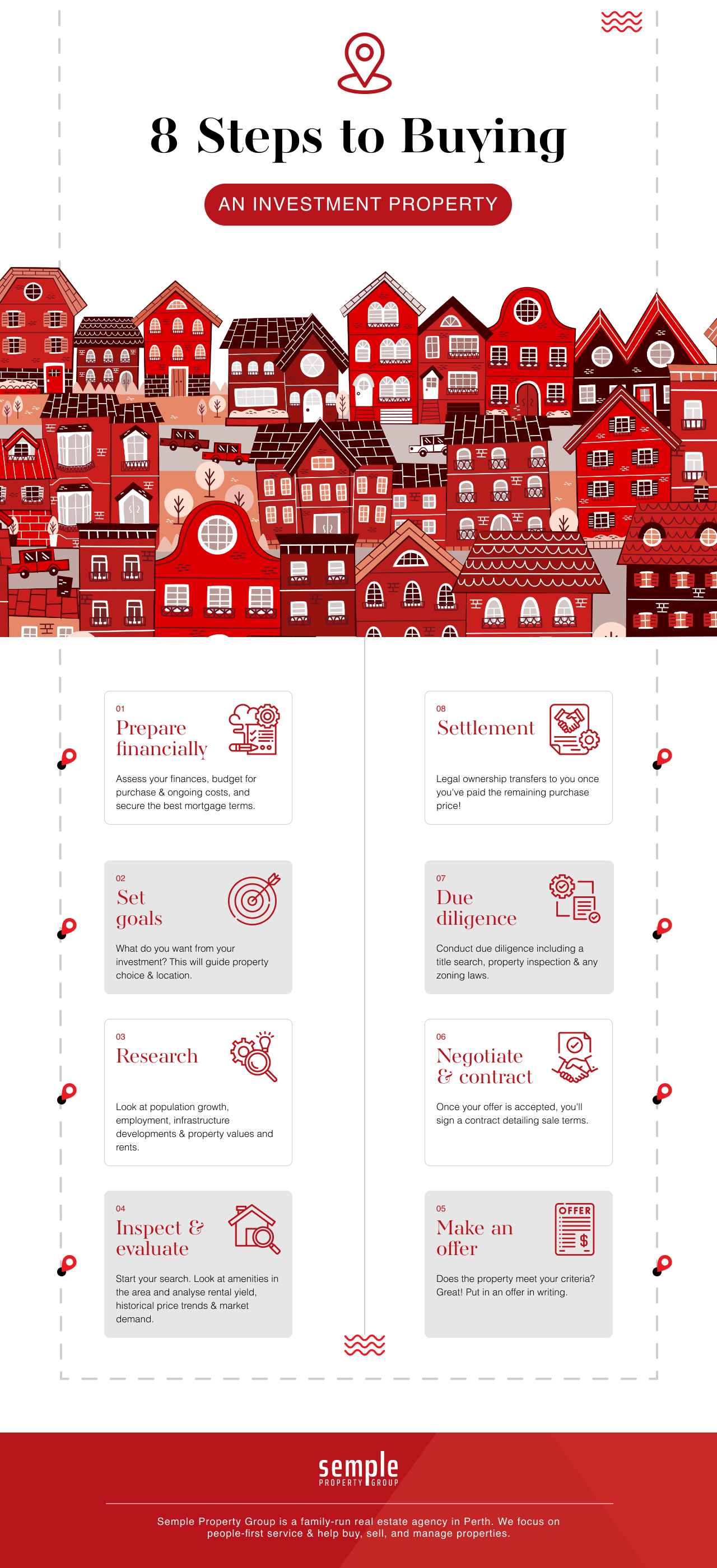

Steps involved in buying

- Make an offer: Once you find a property that meets your criteria, the next step is to make an offer. This is typically done in writing and may include conditions under which you’ll buy, like getting financing or a satisfactory building and pest inspection.

- Negotiate and contract: If the seller accepts your offer, or if you reach a mutual agreement after negotiations, you’ll enter into a contract. This legal document outlines the terms of the sale, including price, deposit amount, settlement date, and any conditions precedent to the final sale.

- Due diligence: Before the purchase is finalised, make sure to conduct a thorough due diligence. This includes a title search to make sure there are no legal impediments to the sale, property inspections, and reviewing zoning laws to confirm the property can be used for your intended purposes.

- Settlement: This is the final phase where the legal ownership of the property transfers from the seller to you, the buyer. It involves paying the balance of the purchase price, typically managed by your legal and financial representatives.

Legal and regulatory considerations

It’s important to understand the legalities around investment property ownership; here’s what you should be aware of.

- Legal checks: It’s a good idea to get a solicitor or conveyancer to perform legal checks, such as making sure the property has no encumbrances, liens, or legal claims against it that could affect your ownership.

- Zoning laws: Understanding zoning laws is crucial as they dictate how a property can be used and what structures can be built. Make sure the property’s zoning aligns with your investment goals.

- Compliance with regulations: Make sure the property complies with local council regulations and building codes, especially if you plan to make modifications or use it for rental purposes.

Work with professionals

- Real estate agents: As we said above, real estate agents play a pivotal role in providing market insights, negotiating deals, and accessing potential off-market opportunities.

- Lawyers and conveyancers: Legalities can get tricky, so getting the professionals to do the legal groundwork can be a huge weight off your shoulders.

- Accountants: An accountant knowledgeable in real estate can advise you on the best financial structures for your investment and help maximise your tax advantages.

Managing your investment

Congratulations! You’ve now acquired your investment property. Effective ongoing property management in Perth now becomes key to maximising profitability and maintaining the value of your investment.

Property management basics

The first decision you’ll have to make is whether you self-manage your property or hire a professional property manager. While self-managing can save you a little bit of money on management fees and give you direct control over tenant selection and management, it’s often a bigger headache than it’s worth. It requires a bigger time commitment and a solid understanding of tenancy laws.

Hiring a property manager eases the burden of day-to-day operations so you have more time to do other things. They handle everything from marketing your property and screening tenants to handling lease agreements and maintenance issues. They also make sure you’re compliant with relevant laws and regulations. Essentially, a property manager is ideal if you’d like to have a hands-off approach to your investment or have multiple properties.

Read more about the benefits of hiring a property manager.

Tenant management

Finding the right tenant is crucial – they directly influence your rental income and the condition of your property. Effective tenant management involves:

- Screening: Conduct thorough background checks including credit, employment history, and previous tenancy behaviours.

- Lease agreements: Make sure agreements are comprehensive and comply with local laws. Clearly outline tenant responsibilities regarding maintenance and rules.

- Rent setting: Set competitive rent rates based on your market research to attract tenants while ensuring a good return on your investment. Regularly review and adjust rent in line with market conditions and property upgrades.

Read more about screening potential tenants.

Maintenance and upgrades

Maintaining your investment property ensures it remains attractive to both current and prospective tenants. It can also have a big impact on your property value. Routine maintenance includes regular inspections, fixing leaks, painting, and ensuring appliances and other systems are functional.

Consider upgrades that increase value or appeal. Big ones include modernising kitchens and bathrooms, improving energy efficiency, or landscaping.

Managing risks

As with any investment, there are some risks that come along with it. Common risks include market fluctuations, unexpected costs from things like emergency repairs or maintenance issues, and problem tenants.

The best way to mitigate risks is to be prepared before they even come up. Make sure you have the right insurance coverage, maintain a reserve of emergency funds for any unexpected costs that come up, and get professional legal insight to make sure your lease agreements and tenant responsibilities are clearly outlined.

Make your move in the property market

Ready to take the plunge into the world of investment properties? Whether you’re a seasoned investor or just starting out, the key to success is informed decision-making and strategic planning.

Equip yourself with the right knowledge and tools to navigate the complexities of the real estate market and maximise your investment potential. Our Perth property managers can help you navigate the market with ease, so you can spend more time doing what really matters. Explore houses for sale or get in touch today!

Related Articles

Where to change addresses when moving house

Where to eat in Perth - our top picks